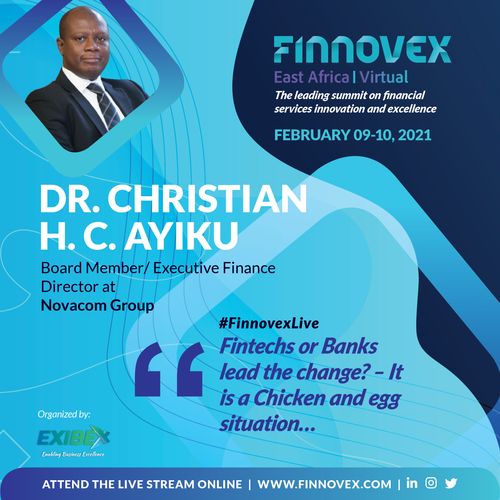

Dr Christian Ayiku Board Member/ Executive Finance Director, Novacom Group

HOME / Dr Christian Ayiku Board Member/ Executive Finance Director, Novacom Group

Dr. Christian H. C. Ayiku, is currently Board Member/ Executive Finance Director at Novacom Atlas Mara. He is a seasoned financial management expert with 18 years of extensive experience in Strategy development and execution and Business Performance Management functions in the banking sector

Dr. Christian H. C. Ayiku will be speaking virtually at Finnovex East Africa Virtual Summit. Please have a look at his view on our upcoming The Leading Summit on Financial Services Innovation and Excellence to held Virtually on 9-10 February 2021 ( Attend from anywhere 💻🖥📱 )

Q- In post COVID-19 era, with the emergence and growth of FinTech and digitalization of banks what do you think would be potential opportunities of the banking industry?

Partnerships will continue to be key for both Fintechs and the Banking industry, however the below opportunities will be of high relevance to banks.

- Rethinking what drives brand loyalty

- Restructuring the addressable market to grow beyond the core

- Ability to reconstruct resiliency plans

- Ability to validate long-standing business assumptions

Q- Also, what would be concerns or challenges of the banking industry?

Challenges for most banks will be around being able to supply relevant products to customers, in return for Profitability, especially as most banks are still not able to harvest relevant customer behaviour from their digital delivery channels

Q- What is the role of CXO (depending on speaker designation) from Developing policies to developing Infrastructure for Digital Transformation in the banking sector?

The role of the CXO is that of an innovator, that seeks to adapt new customer norms with new business models, resulting in business efficiency and excellence.

Q-According to you, who leads the way in change and transformation -Banks or FinTechs? Who inspires, who follows trends and who brings customer needs into perspective?

It’s a chicken and egg situation. Banks deliver products to customers but to do this well, they have to harvest customer behavior via FinTech platforms assuming banks are leveraging on the power of FinTech platforms. So, whereas FinTechs inspire opportunity, Banks follow the opportunity, and together, both Banks and FinTechs are able to bring customer needs into perspective.

Q- What steps would you take in your organization towards building a Cyber Resilient and Digitally Empowered Economy?

Take stock of best practice from a benchmarked perspective, assess where my organization is currently, and develop a roadmap for board approval and execution.

Q- I believe you had a chance to go through our brochure and agenda, what are your thought about this conference? Which session are you looking forward to attend?

It’s an excellent conference and, I intend to participate in all the sessions.

Q- What would you like to say to your industry peers and banking professionals who are looking forward to attend this conference?

EXIBEX conferences are best in class and you cannot afford to miss it. The network value is immense.